Global Markets Slow in Early 2025, Trade Deals Could Be Light at the End of the Tunnel

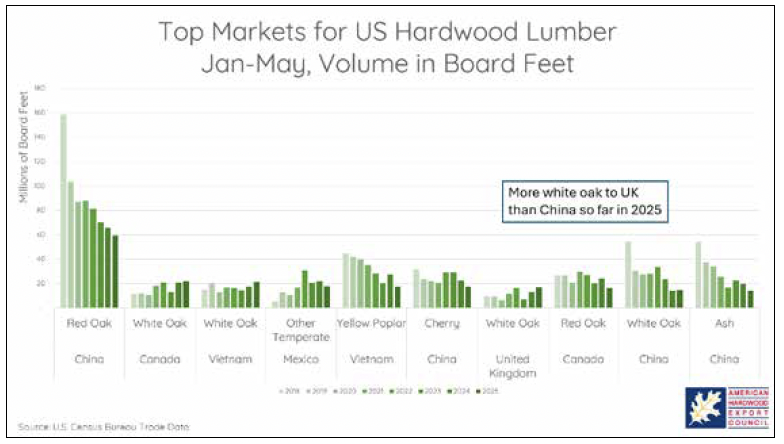

Exports of US Hardwood Lumber were down 13% by volume through May of 2025 compared to the same period last year, as many of our largest markets have faced tariff whiplash through the spring. This graph shows the 10 largest markets for lumber products through the latest available data (May 2025), and the historic trade levels for the first five months of previous years. Volumes declined in 2025 for most of these species and markets – particularly in China.

Through May, China has dropped 18% by value and 23% by volume since last year as the market continues looks at increasing economic uncertainty and high potential tariffs. Although our data only goes to May, a “framework” of a deal with China was announced in June that will drop tariffs down from 145% on Chinese products coming to the US and 125% on our products going to China to 30% and 10% respectively. Although this number is still an additional cost for international trade, it represents a much more manageable number and should provide some stability for the markets. China’s total imports of hardwood lumber are down 9% from all sources in 2025, and Thailand has surpassed the US to be their largest supplier of lumber. Looking at individual species of US lumber going to China, our red oak exports are down another 10% by value, and are down 38% from their peak in 2018. While other markets like Europe and Vietnam have increased their consumption of red oak, we have still not fully replaced the drop in China since 2018. Red oak exports to all markets are down 4% through May.

White oak lumber exports to China have also declined, and for the first time we exported more white oak lumber to the UK, Canada, and Vietnam than to China. This is a massive shift. For reference, in 2018 China imported 54.5 million board feet of white oak through May, and the UK imported just 9.4 million board feet. The Chinese white oak market was more than five times the size of the UK white oak market, and larger than Canada (12 million bf), Vietnam (15 million bf), and the UK market combined. Now, all three of those markets are buying more white oak than China.

The UK market has gotten a boost from stable trade relations and is up 19% through the first five months. By volume the UK increased by 4.4 million board feet from last year, which was the largest growth for any country. Compared to 2023, the market increased by 10.7 million board feet. Another factor boosting the UK’s trade is that the market does not have to comply with EUDR regulations unless the material is being traded into Europe at a later date.

As more trade deals are hopefully announced in the coming weeks, we look forward to a busy international calendar promoting American hardwoods all over the world. AHEC will host pavilions at trade shows in Mexico in August, China, India, and Indonesia in September, and Vietnam in November along with numerous design and educational projects. For more information on AHEC, please visit www.americanhardwood.org.

By Tripp Pryor, International Program Manager, AHEC

Share:

Related News & Blog

September 1, 2025

September 1, 2025

Questions?

Have questions or need any assistance regarding the NHLA Annual Convention & Exhibit Showcase?