Economic Uncertainty Continues Affecting Tie Demand Outlook

Tariffs & Trade Policy Drive Market Uncertainty

The labor market remains resilient, with unemployment holding steady at 4.2 percent—a rate widely regarded as the natural level. Initial jobless claims have remained low, and labor force participation stands at 62.6 percent—in a tight range for more than a year. Personal Consumption Expenditures (PCE) were somewhat softer, increasing by annualized 1.2 percent. Meanwhile, interest rates on government bonds have inched up, pushing mortgage rates close to 7 percent. Added to this complex landscape is the unpredictable nature of U.S. tariff policy, which contributes to uncertainty in trade and pricing. Still, inflation indicators showed some moderation in April, with the Consumer Price Index (CPI) rising just 2.3 percent year-over-year, slightly below expectations and easing fears of immediate price surges from import taxes.

RR Performance Amid Challenges

Partially because of container imports, Class I railroads posted good results despite several challenges. For some, it was a tough winter where the RRs had to reduce train speed when the temperature dropped below -13 degrees Fahrenheit (-25C). For others, it was torrential rains causing some parts of the tracks to be washed away as well as a bridge in Arkansas, for example. On average, revenue was up in the lower single-digit percentage points with volume up by 4.5 percent carloads (AAR week 13 report). Most of the gains came from the intermodal category, as the trains carried the influx of imports from ports inland. For smaller railroads, the picture looked similar in terms of carloads. The total volume increased by 0.6 percent, carried by a 7 percent increase in intermodal.

Hardwood Market Faces Uncertainty

It is an understatement that current economic uncertainty also weighs on sawmills. David Caldwell of Hardwood Market Report (HMR) stated that “China is the largest trading partner for grade hardwood lumber. The 90-day pause on escalated tariffs only allows sellers to ship for about three weeks in order for lumber to reach China before the pause expires. Until there is a permanent solution to the trade war, sawmills and concentration yards are unsure how to proceed.” He also expressed concerns that if this uncertainty does not end soon, more sawmills will close.

Industrial Lumber Demand & Pipeline Projects

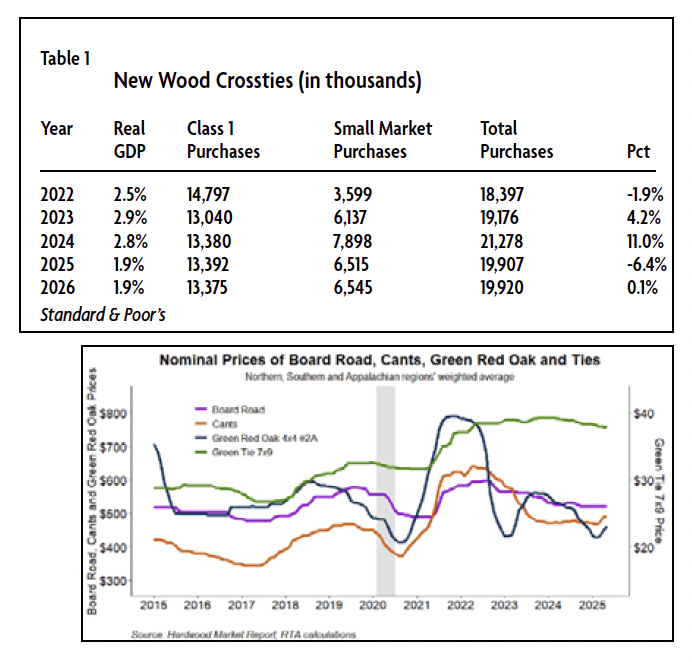

When it comes to industrial lumber, the situation is evolving. Demand for board road is on the upswing, driven not only by seasonal factors but also by pipeline construction projects (HMR). Additional growth may be on the horizon, as there has been a notable increase in applications for pipeline projects since late last fall (Federal Energy Regulatory Commission). Demand and pricing for hardwood pallet cants has marginally improved, likely due to an increased demand for container shipping and lower velocity of pallet circulation as importers stockpiled inventories (Figure 1). Purchases of ties were good in 2024. In fact, they exceeded RTA’s forecast by nearly 6 percent, largely due to a 74 percent increase in Consolidated Rail Infrastructure and Safety Improvements (CRISI) grants compared to the previous fiscal year. However, in Q1, tie purchases slowed down. In conjunction with this, increased tie inventories put the inventory-to-sales (ISR) ratio at an extremely high level. In turn, the high ISR put marginal pressure on pricing.

RR CapEx & Small Market Demand Outlook

Tie demand outlook for the remainder of the year is virtually unchanged from the previous forecast despite macroeconomic uncertainty. Starting with the Class I demand, RRs expect lower freight volume in Q2, especially from intermodal, as the front-loading wave should end soon. (A note of a caution: It is likely that when imports swing the other direction, making GDP look better, RRs will have fewer containers to carry). They also expect a slight rebound in the second half of the year. As such, RRs confirmed their outlook for CapEx spending in 2025 – virtually the same level as last year in nominal dollars (Class I Q1 earning calls).

CRISI Grants & Tie Demand

When it comes to the small market, the situation has been clouded by the unpredictability of the CRISI grants provided by Congress. For this year, RTA assumes the level of the grants to be about half of the prior year. Assuming this holds, the total demand for ties is estimated to decline by about 6.4 percent (Table 1). For the 2026 outlook, great uncertainty remains for the economy and for the CRISI grants.

By Petr Ledvina, RTA Economist

Share:

Related News & Blog

August 1, 2025

August 1, 2025

Questions?

Have questions or need any assistance regarding the NHLA Annual Convention & Exhibit Showcase?